Supplemental Coverage Option (SCO)

The Supplemental Coverage Option (SCO) is an area-based* crop insurance endorsement that provides additional coverage for part of your deductible under your underlying crop insurance policy. It’s a powerful tool for producers whose yields and revenues tend to align with county averages.

*SCO is based on Production Area, which many times is equivalent to the county. However, it is important to remember that they can differ. Production Area for ECO/SCO/ARP: The geographical area that the expected and final area yields are based on, designated generally as a county, but may be a smaller or larger geographical area as specified in the actuarial documents.

Why strengthen with SCO?

- SCO offers up to 86% coverage and follows the underlying policy.

- SCO is area-based, which benefits producers whose yield and revenue correlate with the county.

- Utilize with the Enhanced Coverage Option (ECO)** for coverage as high as 95%.

** ECO is only available on select crops across the U.S. Please speak to your NAU Country Agent or Marketing Representative for further details.

*** Coverage information reflects the 2026 Crop Year. Updates are anticipated for the 2027 Crop Year.

Upcoming SCO enhancements

The Risk Management Agency (RMA) will update the SCO policy for the 2027 Crop Year to increase the maximum coverage level from 86% to 90%. For the 2026 Crop Year, insureds can cover this band of insurance with ECO and will receive the same 80% premium subsidy on their ECO coverage that is now offered for SCO. This will functionally allow producers to access SCO coverage up to the 90% level for the 2026 Crop Year.

How does SCO work?

SCO follows the coverage of your underlying policy. If you choose Yield Protection (YP), then SCO covers yield loss. If you choose Revenue Protection (RP), then SCO covers revenue loss.

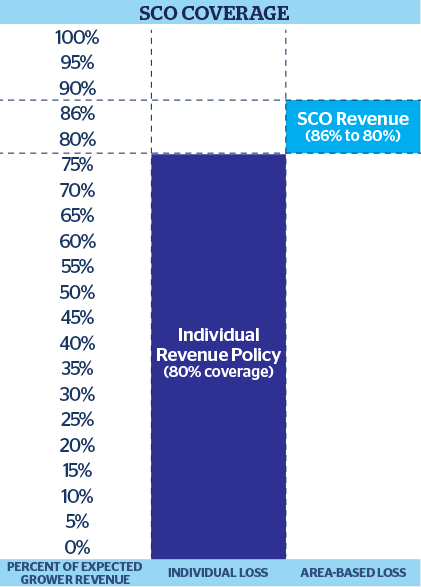

The amount of SCO coverage depends on the liability, coverage level, and approved yield for your underlying policy. However, SCO differs from the underlying policy in how a loss payment is triggered. The underlying policy pays a loss on an individual basis, and an indemnity is triggered when you have an individual loss in yield or revenue. SCO pays a loss on an area basis, and an indemnity is triggered when there is a loss in yield or revenue at the county level.

For example, suppose a grower’s corn crop has an expected value of $765.00 per acre (170 bushels at $4.50 per bushel). Assume the grower buys a Revenue Protection (RP) policy with an 80% coverage level (this is the ‘underlying policy’). The underlying policy covers 80% (or $612.00) of the expected crop value, leaving 20% (or $153.00) uncovered as a deductible.

At this point, the grower has the option to buy SCO coverage. Since the underlying policy is Revenue Protection (RP), SCO will also provide revenue protection, except that payments will be determined at the county level. SCO revenue coverage is described in the table.

The SCO Endorsement begins to pay when the county average revenue falls below 86% of its expected level. The full amount of the SCO coverage is paid out when the county average revenue falls to the coverage level of the underlying policy. In this example, it is 80%.

SCO payments are determined only by county average revenue or yield and are not affected by whether you receive a payment from your underlying policy. So, it is possible for you to experience an individual loss but not receive an SCO payment, or vice versa.

Purchase decisions

- SCO must be purchased with an underlying individual policy. They consist of: Actual Production History (APH), Yield Protection (YP), Revenue Protection (RP), or Revenue Protection with Harvest Price Exclusion (RP-HPE).

- SCO uses its own Administrative Fee ($30), as well as premium. The premium is subsidized at 80%.

- SCO coverage will mimic how the underlying policy works.

- If the underlying policy provides Revenue Protection, then the SCO will provide revenue coverage on an area-basis.

- If the underlying policy provides Yield Protection, then the SCO will provide yield protection on an area-basis.

- The SCO liability (maximum payout) will be based on the expected crop value (the insured’s APH) for the individual grower.

- Producers may reduce their SCO liability by a “coverage percentage” elected on or before the Sales Closing Date. The range is from 50%-100%.

- If allowed in the actuarial, separate supplemental protection is available for each practice, type, and coverage level.